Actuarial Science

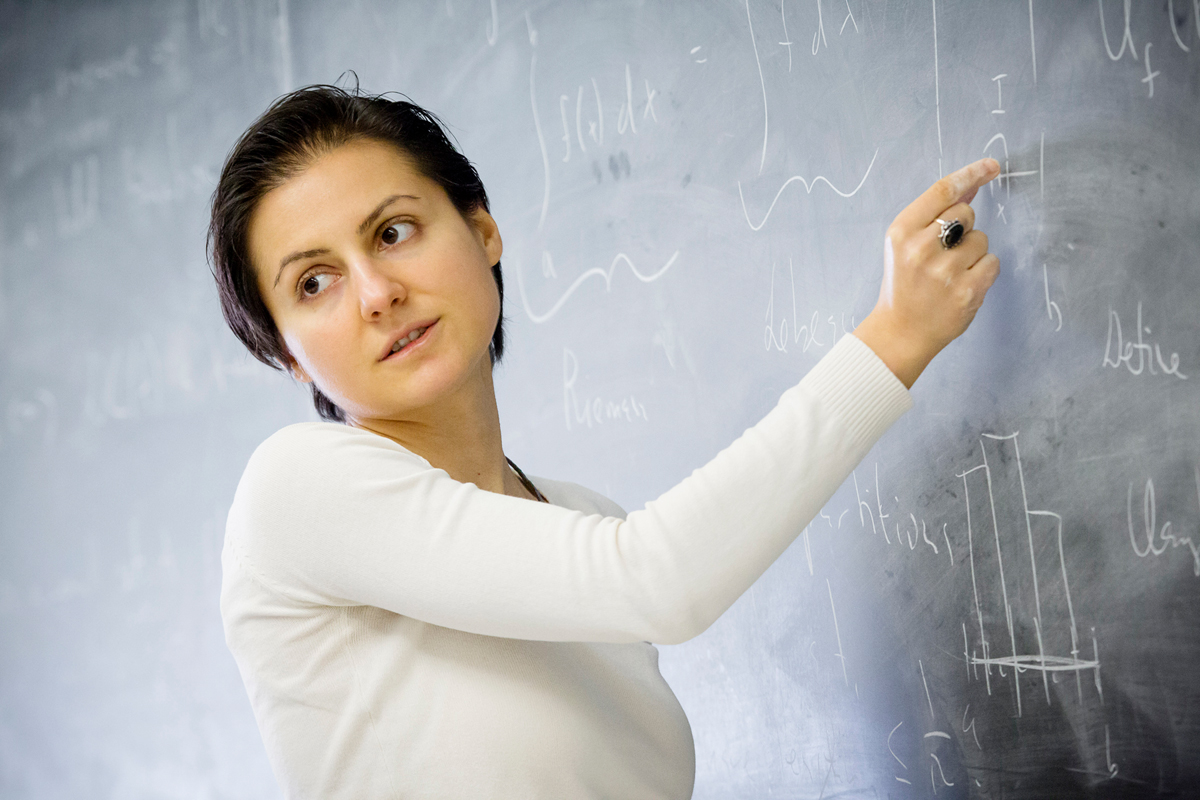

An actuary is a combination of business executive, mathematician, financier, sociologist, and investment manager. Actuaries are problem solvers who use actuarial science to define, analyze, and solve the financial, economic, and other business applications of future events.

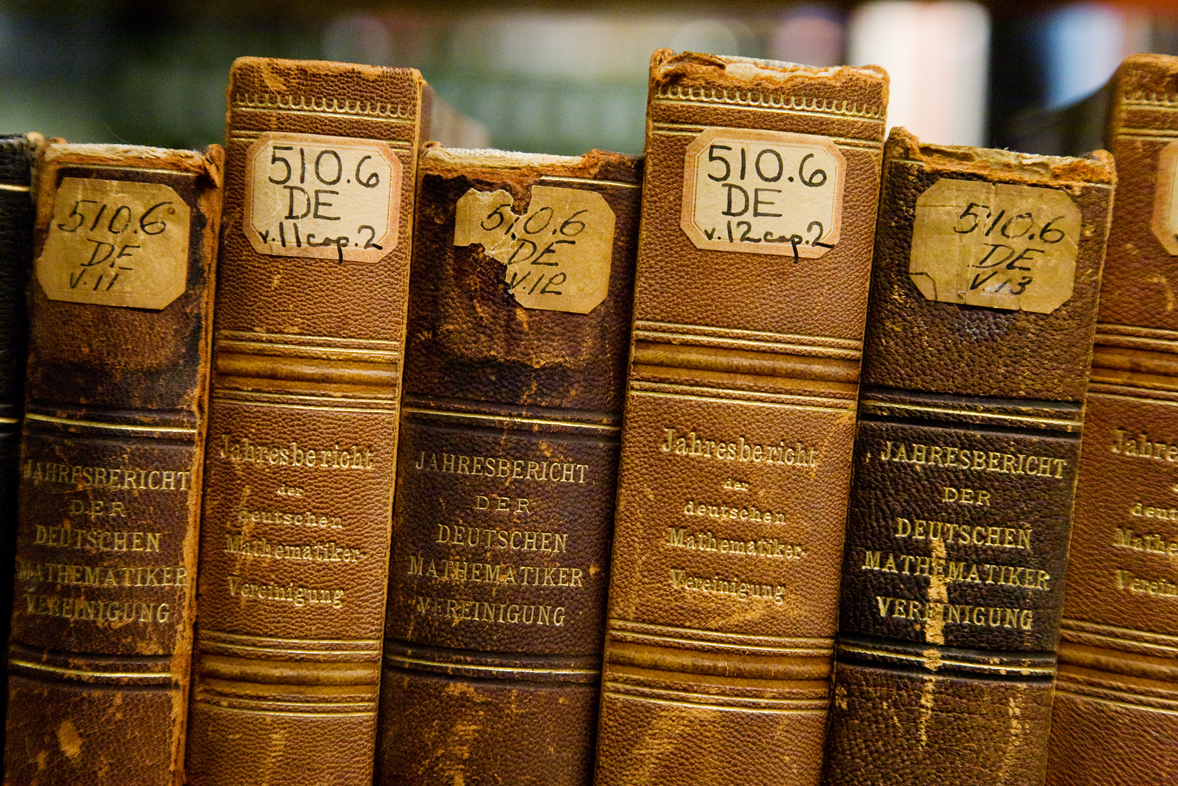

The actuary's responsibilities date back to the early 1800's, when most actuarial work centered on developing mortality tables and life insurance policies. Today most actuaries are best known for their work in the insurance and pension fields, where they design financially secure benefit programs to protect people. But that is changing, and actuaries are finding themselves involved in many other areas.

Trained to analyze uncertainty, risk, and probabilities, actuaries create and manage programs which will reduce the adverse financial impact of the expected and unexpected things that happen to people and businesses. These programs focus on areas such as life, health, property, casualty, and investment possibilities.

- MATH 220, MATH 231, MATH 241—Calculus I, II, III

- CS 101/105/125—Introduction to Computer Science

- ASRM 210—Theory of Interest

- ECON 102—Microeconomic Principles

- ECON 103—Macroeconomic Principles

- FIN 230—Introduction to Insurance

Students should consult with an academic advisor regarding course selection prior to the advanced registration period.

Actuaries work for a variety of employers including insurance companies, consulting firms, government departments, colleges and universities, banks and investment firms, etc.

- Analyzing insurance rates, such as for cars, homes or life insurance

- Estimating the money to be set-aside for claims that have not yet been paid

- Participating in corporate planning, such as mergers and acquisitions

- Calculating a fair price for a new insurance product

- Forecasting the potential impact of catastrophes

- Analyzing investment programs

- Actuarial Analyst

- Actuarial Assistant

- Financial Analyst

- Risk Analyst

- Financial Engineer

- Project Manager

- Researcher

- Budget Analyst

Some careers may require education beyond an undergraduate degree.

- Participating in undergraduate research

- Applying for a study abroad experience

- Utilizing resources of The Career Center

- Joining a Registered Student Organization (RSO) related to this major, such as:

- Actuarial Science Club: The Actuarial Science Club offers both social and professional events, including company presentations, Meet the Firms, field trips to visit insurance and consulting firms, study groups, bowling and other social events.

There are several professional organizations dedicated to Actuarial Science. Their websites might be able to provide a glimpse in the world of Actuarial Science. For more information about actuarial science, check out Be an Actuary. More organizations include: Casualty Actuarial Society and Society of Actuaries.